Table of Contents

ToggleBiography

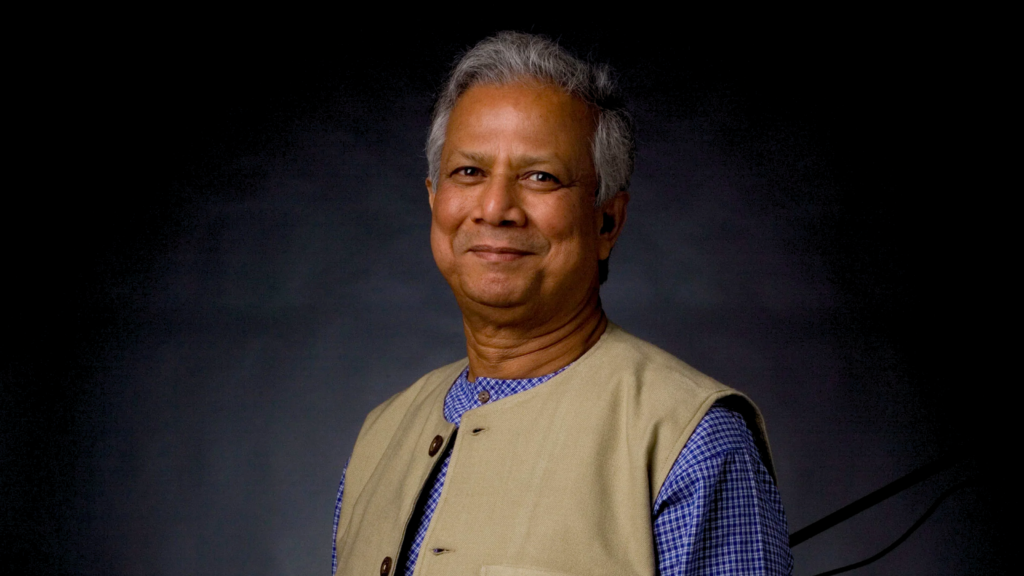

| Real Name | Muhammad Yunus |

| Nick Name | Yunus |

| Other Name | Banker of the poor |

| Date of Birth | 28 June 1940 (Friday) |

| Age | 84 Years Old (Till 2024) |

| Place of Birth | Village Bathua, Hathazari, District Chittagong, Bengal, British India |

| Nationality | Bangladeshi |

| Religion | Islam |

| Profession | • 2024: Head-elect of the Interim Government of Bangladesh • Economist • Banker • Entrepreneur |

Family

| Father | Haji Dula Mia Soudagar (jeweler) |

| Mother | Sufia Khatun |

| Brother | • Muhammad Ibrahim (a professor of physics, founder of the Center for Mass Education in Science) • Muhammad Jahangir (a television presenter and social activist) |

| Sister | None |

| Wife | • Vera Forostenko Yunus (m. 1970 – div. 1979) (died in 2017) • Afrozi Yunus (a researcher in physics and a professor at Jahangirnagar University) (m. 1983) |

| Kids | Daughters– 2 • Monica Yunus (from first marriage) (American musician) • Deena Afroz Yunus (from second marriage) |

Physical Measurements

| Height | 5 feet 5 Inches (1.65 m) |

| Weight | 65 kg |

| Hair Color | Salt & Pepper |

| Eye Color | Black |

| Body Measurements |

Education

| School | • Primary education from Lamabazar Government Primary School, Sylhet, Bangladesh • Matriculation from Chittagong Collegiate School, Bangladesh |

| College/University | • University of Dhaka, Bangladesh • Vanderbilt University, Nashville, Tennessee |

| Qualification | • B. A. (1960) and M. A. (1961) from University of Dhaka, Bangladesh • Ph. D. from Vanderbilt University, Nashville, Tennessee (1971) |

Career

| Discipline | Economics |

| School/Tradition | • Microcredit • Social Business |

| Notable Works | • Grameen Bank • Microcredit • Social Business |

| Awards, Honors, Medals, Achievements | • Ramon Magsaysay Award, Philippines (1984) • Independence Award (1987) • Humanitarian Award, CARE, USA (1993) • Mohamed Shabdeen Award for Science (1993) • World Food Prize (1994) • International Simon Bolivar Prize (1996) • Sydney Peace Prize (1998) • Indira Gandhi Peace Prize (1998) • King Hussein Humanitarian Leadership Award (2000) • Ashoka: Innovators for the Public Global Academy Member (2001) • Volvo Environment Prize (2003) • Nikkei Asia Prize for Regional Growth (2004) • Franklin D. Roosevelt Freedom Award (2006) • One of The 25 Most Influential Business Persons of the Past 25 Years by Wharton School of Business in Philadelphia (2006) • Nobel Peace Prize (2006) • Seoul Peace Prize (2006) • One of the top 12 business leaders, including him among “60 years of Asian Heroes” by Time Magazine (2006) • Presidential Medal of Freedom (2009) • The most influential thinkers by Foreign Policy magazine (2009) • Congressional Gold Medal (2010) • Listed 40th among “The World’s 50 Most Influential Figures by New Statesman (2010) • He has received 50 honorary doctorate degrees from universities in 20 countries and 113 international awards from 26 countries. • One of the 12 greatest entrepreneurs of the current era by Fortune Magazine (2012) • Prince of Asturias Award for Concord (2012) • Olympic Laurel (2021) • United Nations Foundation’s Champion of Global Change Award (2021) |

| Controversies | Yunus and Grameen Bank’s Operations • On 27 January 2011, Yunus faced a food adulteration case for producing yoghurt below the legal minimum fat content. • A 2012 independent commission report accused Yunus of misrepresenting his authority and raised questions about Grameen Bank’s operations and management of its assets. • Yunus has faced 174 lawsuits in Bangladesh including labour law violations and corruption, which he claimed were politically motivated. • Sheikh Hasina’s government has launched trials against Yunus, citing age and earnings issues. • On 1 January 2024, Yunus was sentenced to six months in prison for labour law violations but was granted bail pending appeal. |

Money Factor

| Net Worth | $10 Million |

| Assets/Properties | |

| House | |

| Car |

Social Media

| click here | |

| click here | |

| click here | |

| click here | |

| YouTube | click here |

The man who helped the poor: Muhammad Yunus

Muhammad Yunus is a Bangladeshi social entrepreneur, banker, economist and civil society leader. A true “Banker to the Poor” where he dedicated his life in serving those less fortunate, giving them an avenue out of poverty by virtue initially founded on pioneering work in microfinance. His creative ideas, especially on the founding of Grameen Bank have empowered millions — among them countless women in Bangladesh and elsewhere to elevate themselves out of poverty. He has won many, mostly Nobel Peace Prize. Let us take articles through the life, accomplishments and wonders of his world.

Early Life and Education

Born into a Islamic family in 1940

Muhammad Yunus was born in the village of Bathua on June 28,1940 which is located currently situated in Bangladesh. The third of nine children, George was raised in a family that placed great importance on education and social responsibility. His father, Hazi Dula Mia Shoudagar used to a successful jeweler and his mother Sofia Khatum was very punctual about her activity, she was also conservative women. Yunus, who grew up in a family that valued service to others and was inspired by his mother’s empathy and father’s belief of universal education system likelihood.

1957-1960: Getting Educated at College and Graduate University

Yunus was an intelligent student, who studied in Chattagram Collegiate school and did well academically. In 1960, he completed his Bachelor in Economics from Dhaka University. What he learnt in his primary and secondary schooling helped to support him as an economist working within a social science of justice.

1961- 65: Fulbright scholar, United States

Yunus was awarded a Fulbright scholarship after graduating with his Bachelor trivia. He attended Vanderbilt University in Tennessee, earning a master’s degree in economics before moving to California for his Ph. D. in Economics in 1969. While in the U.S., Yunus became acquainted with numerous social movements, including Civil Rights Movement which fashioned his views on poverty, inequality and how economics should serve a huge role alleviating such problems.

The Birth of an Innovative Idea

1972: Back to Bangladesh and Academic Life

Yunus moved back to Bangladesh in 1972 after his country, following the Liberation War of nine months, achieved its independence. He was teaching at Chittagong University as the Islamic Economics department head. he joined there by1980 after finishing his Ph.D in 1979 from JNU honed and trained himself for years on job_mkts of muslim lands, africa nomanclatur tribalasim.iterlinked claims reinvented appended without info? Relevant tags.None Gas deve_TRY. Even with his professional success on the increase, Yunus — who was born in Bangladesh but grew up primarily in Myanmar and then attended Vanderbilt University for his econ degree — increasingly found it difficult to square what he saw outside that bank’s vaults, especially when he ventured into rural areas. It dawned on him that the theoretical underpinnings of economics which he had preached in his lectures did not provide all the answers to solving poverty.

1974 The Famine & the $27 Loan

Thousands and thousands of people starved to death in these areas and many others were rendered destitute because they could not find enough food. The most terrible event that the country had even seen was taking place before our eyes — literally right baseline us for miles out on all directions. This incident had changed Yunus deeply. Desperate to volunteer, he started volunteering in the village next door Jobra and met a group of poor women who were making bamboo stools. The reason they were mired in poverty limbo is because these women had to borrow money from local strongholders whose interest rates flew into the stratosphere…

Yunus said he started his experiment with the $27 loan from her savings to 42 women of Jobra in 1976 so they did not need take moneylenders help for buying materials. The women were able to pay back the loan through higher profits from their businesses and begin to work themselves out of destitution. This small experiment revealed to Yunus that any money however minute can change the world for a poor person.

Founding Grameen Bank

1976: Birth of Grameen Bank

Buoyed by his $27 success, Yunus set out to build a whole platform for helping more people. It all started in 1976, when he lent small amounts of money to the poor people from Jobra and neighbouring villages. This marked the birth of what would later be called Grameen Bank, meaning “Village Bank” in Bengali.

1983: The official start of Grameen Bank

Grameen Bank officially established as an independent bank in Bangladesh, 1983 What set Yunus’s bank apart was that it specialized in microloans—small loams to the most destitute, particularly women on an unsecured basis. In the first sentence, note that earlier in history most of these poor would not have received any money from a bank because they could offer no assets or property as collateral and this forced people on to temptation road. Grameen Bank, however believed that even the poorest of people would pay back their loan if they had a chance; Yunus proved to be right.

The Grameen Bank arrived at its innovative approach through a number of basic insights:

Micro loans: small scale credit, often of a few dollars to enable persons to establish or expand bone business.

Non security: The borrowers were not require to place any of their property or assets as a collateral.

Mainly Female Borrowers: Most borrowers were women who are usually on the bottom rung of social ladder

Rumor Group: a group of lenders that each person in the cohort takes their own loan but supports one another to repay it back.

Early Successes and Expansion (1984-1989)

Grameen Bank grew quickly throughout rural Bangladesh in its first years. By 1984, the bank had set up branches in a number of remote districts as well and served thousands of borrowers. The successes of the bank did not go unnoticed — by 1989 it appeared that Grameen Bank had a concept capable to be transferred abroad.

During this period Grameen Bank brought in various programmes for the poor like saving accounts, insurance and education loans. The services helped the borrowers not only to develop their businesses but also ensure protection in future and invest for children education.

Global Recognition and Impact

The 90s: Spreading Microfinance

In the early 90s, Grameen Bank had taken its model to a global scale. Grameen-style microfinance institutions were set up in more than 100 countries — including Asia, Africa and Latin America as well the developed world, like USA. He defelegant capitalists who utilized the Yunus model of microfinance — giving loans to low-income free assets holders and women-centricacy lending.

1994: The World Food Prize

Yunus was awarded the World Food Priza in 1994, which is one of the highest honours in respect of agriculture and development. This award was in recognition of his work for the development and use of microfinance in Bangladesh, to improve food security (2006 ) & beyond poverty reduction. It recognized Yunus was pioneering by finding ways for the impoverished to make enough money on their own that they would not go hungry.

1997: The Microcredit Summit

The first Microcredit Summit was held in 1997 in Washington, D.C. and convened thousands of people around the world who are involved with microfinance to make a difference by attacking poverty from all conceivable angles. Committed to extending the benefits of microcredit, this Summit set a goal of reaching 100 million poorest families by the year 2005. A global movement, largely supported by the presence and advocacy of Yunus in this space huge demonstration effect arguing for microfinance to be taken seriously as a poverty reduction tool was born.

Sen — Then and Now 1999: Grameen Bank

As of 1999, Grameen Bank has made loans to more than 2.3 million borrowers in Bangladesh and nearly all have been paid back with an interest rate over repayment a little above the break-even target at which Grameen was loss-making proposed by Muhammad Yunus there repayments are just high enough that no profit will be generated but also one big problem is ethical receiving investment money through some shell non-profit entity based on Netherlands or Panama this way you can fund politicians without sharing their profits legitimate;y. This bank demonstrated that the poor could be reliable borrowers, and one loan at a time he was helping them to build better lives. It has also paved a way for other micro finance institutions in different countries throughout the world, which enabled millions to step out of poverty.

Winning the Nobel Peace Prize

2000-2005: Rapid Expansion And Innovation

Yunus spend the early 2000 further innovating and expanding Grameen Bank. The bank promoted new programs for other social problems such as health, education and housing. Grameen Bank has also gotten deep into promoting rural green energy and other environmental sustainability activities.

2006: Nobel Peace Prize

Muhammad Yunus and Grameen Bank received the Nobel Peace Prize in 2006. The award was given in recognition of their efforts to empower the poor through microfinance and create economic development along with social change from bottom-up. The Nobel Committee cited Yunus for his efforts to promote peace and authenticity through assisting in the eradication of poverty and extreme disparity.

It catapulted Yunus and Grameen Bank into the spotlight internationally. The event also emphasized the significance of microfinance in attaining global development objectives related to social and economic progress, poverty alleviation, combating inequalities between women and men.

Honorary Degrees and Awards, 2007

After the Nobel Peace Prize, Yunus was awarded more than 50 honorary degrees from universities and institutions around the globe. For this work he was honored for contributions to social entrepreneurship and human rights by recognition as a Laureate of both the Schwab Foundation and Right Livelihood Awards, and in economics with an Honorary Doctorateocioeconomic Rights Award. A few of his important awards include the Congressional Gold Medal (USA, 2010), Presidential Medal of Freedom (USA, 2009) and King Hussein Humanitarian Leadership Prize(Jordan,2008).

Challenges and New Directions

Controversies and Criticisms: 2008—2010

Ironically, while it remains widely lauded today as the key to ending poverty in many cases during this period microfinance also experienced extensive criticism. A few people believed that microloans would result in over-indebtedness, when borrowers took more loans than they could pay back. Some were criticised for their high rates of interest and aggressive debt collection practices, which seemed out of keeping with the original idea or remit to lower-income people.

Yunus said he didn’t dispute these problems, but also stated that as long as it was conducted ethically microfinance would always be an effective solution to poverty mitigations. Transformation. rather than portraying it as a pure for-profitisting business, he stressed the need to imlement on the social mission of microfinance

a profit-driven industry.

2011: Battle with the Bangladeshi Government

In 2011, Yunus would be dealt a severe blow, as the Bangladeshi government had him ousted from his job as Grameen Bank’s managing director. But the government said Yunus was above his position’s retirement age. But to many observers his ouster appeared politically inspired, given that Yunus had flirted with entering politics and been critical of the government.

The immediate concerns were for the future of microfinance in Bangladesh and also about Grameen Bank’s independence. Still, Yunus soldiered on; he cornered the rhetoric of poverty rights and good microfinance governance.

Social Business — Saline: A New View of the Road Ahead

Social Business (2008-Present)

A new concept of Yunus in the late 2000 s that he called social business. Social business is a company that helps people in poverty, illiterate and environmental problems. Unlike typical businesses, social-businesses are not out to make HUGE profits. But rather than making profits for shareholders, all the money they make is ploughed back into their work helping more of us.

Yunus was of the opinion that social business could be a significant help towards solving some of humankind worst problems. Over time he developed the idea that applying business methods to social ends could yield sustainable solutions with scalable lasting effects.

Grameen Danone [2009]

One of the first social businesses that Yunus would help to establish was Grameen Danone, a partnership betweenGrameen Bank and the French multinational. In Bangladesh, Grameen Danone makes yogurt for children to tackle malnutrition. The yogurt is cheap — a must if poor families are expected to buy it in any quantity, and the profits help pay for better quality even as they go toward global expansion.

Grameen Danone went on to be a model for other social businesses globally. An example of how cooperation between companies can contribute to the resolution of social problems and be financially viable.

The Year 2010: Grameen Shakte and Renewable Energy

Another notable social business that Yunus initiated is Grameen Shakti aimed at providing clean energy solutions for the rural people of Bangaldesh. In the villages where there is no electricity Grameen Shakti has installed millions of solar home systems. Not only has this enhanced the lives of respective families in these rural areas, but it also helped make a more conducive environment by reducing dependence on fossil fuels.

Grameen Shakti is also credited with having inspired similar projects in other countries which suggested that renewable energy could be a strong economic force both socially and environmentally.

Influence and Legacy of the Hoosier Group

2011-2020: Turn Over a New Leaf

The work of Muhammad Yunus has been an inspiration and call to action for others in the form of us thinking, how we can serve more? A number of youth have already created their own social business or joined existing ones, microfinance for the poor. His books among them, Banker to the Poor and Creating a World Without Poverty have been translated into dozens of languages and remain an inspiration for countless social entrepreneurs world-wide.

Yunus’s focus on women as the most impacted and influential among poor populations has had an enduring influence in development policy making. Microfinance has been widely embraced by international organizations such as the United NationsA history of economic livelihood and gender equality.

2014: Establishment of the Yunus Centre

HistoryYunus established the Yunus Centre in Dhaka, Bangladesh on 14 November [11]993. There is a global hub for social business and microfinance by this name, the Yunus Social Business-Centre at Hyderabad. It focuses on research, advocacy and capacity-building to promote the principles of social business and helps both establish new lines of thinking around it as well as support its practical implementation with growing numbers…. The Yunus Centre also holds annual Social Business Days, which are a meeting place for academics and policy makers together with social entrepreneurs to exchange ideas as well as results.

The Yunus Centre has been instrumental in promoting the ideas of Mr. Yunus and assisting with social business development worldwide It perseveres in delivering win-win solutions to the world problems: from poverty and unemployment, through climate change and health.

Its Way Forward to a More Peaceful and Prosperous 2016

He entered a new phase in 2016, initiating The Road to Peace and Prosperity that unites social business with microfinance and sustainable development as the pathway for global peace & prosperity. He thinks it is possible to build a more peaceful and poverty free world if we address the root causes of these issues.

The effort is centered on driving cooperation between governments, businesses and civil society to stimulate sustainable economic expansion while giving everyone a chance at success. And a future for all, that must be sustainable environmentally.

Conclusion

The life and work of Muhammad Yunus stands as an example that innovation never recognizes age or demarcations on the grounds of social justice! He has, via the building of Grameen Bank and pioneering microfinance on an industrial scale, managed to pull millions out poverty by empowering them with credit. By introducing the idea of social business he has shown new ways to tackle even those problems that preceded our civilisation, proving companies could do some good in world if their purpose was no longer profit but turning human suffering into opportunity. This shift is essential for us — we are not merely capitalists or socialist.. we see capitalism as a tool and socialism as an approach.

Yunus brings to us a legacy that lies not only in the institutions he has constructed but also in millions of lives and spirits whom he has awakened, while grooming an entire generation of fresh-faced social entrepreneurs. She concludes: At a time when the world is struggling with poverty, inequality and sustainability, Yunus argues for how we can create an inclusive global society. His dream of a world without poverty, and in which every life has equal worth no-strings attached, is as challenging today.

Year-by-year Achievements & Progress

The following a breakdown of some of Muhammad Yunus’s key accomplishments and land-marks.

1940: Bathua, Chittagong, Bangladesh

1960: Passes from Dhaka University in the subject of Economics

It is also completed in the United States, 1961-65: Study trip (with Fulbright scholarship) and receives Master’s degree furthermore Ph. He holds a Ph. D in Economics from Vanderbilt University

1972: Goes back to Bangladesh; serves as chairman of the Department of Economics, Chittagong University.

1974: Sees the Bangladesh famine (encouraging him to address poverty, directly)

1976: Lends $27 to 42 women in Jobra village; starts beta-testing microloans when experiments prove unsuccessful, sparking the creation of Grameen Bank.

1983: officially recognized as an independent bank in Bangladesh and was given the charted of Grameen Bank.

Apr 1994:Winner of World Food Prize (his work using microfinance for food security)

1997: Participated in the first Microcredit Conference – Summit That Convened 2,900 people from different continents to Washington, DC;

1999: Grameen Bank has 2.3 million borrowers, each with a loan repayment rate of over 95% [iv]

2006: Won the Nobel Prize for Peace along with Grameen Bank

2009: Awarded the Presidential Medal of Freedom by the US.

Congressional Gold Medal, U.S. Congress honoree (2010)

The 2011 sacking of Grameen Bank managing director by the Bangladeshi government

2012: Launches the Yunus Centre based in Dhaka, Bangladesh to advance social business and microfinance.

2016 — His ‘The Road to Peace and Prosperity’ Initiative.

2018: Renews advocacy for social business and sustainable development at global forums and conferences.

The road ahead for Muhammad Yunus is long. In his 80s, he has not stopped to inspire by example and engage in the hard fight for an equality of opportunity where everyone has a chance at success. His work serves as a reminder that, with empathy and ingenuity, we can work to improve the lives of others — even in new ways or under unprecedented circumstances—and help lay a foundation for an equitable future.

Here are some frequently asked questions (FAQs) about Muhammad Yunus, along with their answers:

FAQs About Muhammad Yunus

1. Who is Muhammad Yunus?

- Muhammad Yunus is a Bangladeshi social entrepreneur, economist, and Nobel Peace Prize laureate who is best known for founding Grameen Bank and pioneering the concepts of microcredit and microfinance. These financial innovations help poor people, especially women, to start or grow small businesses and improve their lives.

2. What is Grameen Bank?

- Grameen Bank is a bank in Bangladesh founded by Muhammad Yunus in 1983. It provides small loans, known as microloans, to poor people who do not have access to traditional banking services. The bank focuses on lending to women and operates on a model of trust, without requiring collateral.

3. What is microfinance?

- Microfinance refers to the provision of financial services, such as loans, savings accounts, and insurance, to people who are typically excluded from traditional banking services because they are too poor. Microfinance aims to empower the poor by giving them the financial tools they need to improve their economic situation.

4. What is microcredit?

- Microcredit is a specific type of microfinance that involves providing small loans to poor individuals or groups to help them start or expand small businesses. These loans are usually given without requiring collateral and are repaid in small, manageable installments.

5. Why did Muhammad Yunus win the Nobel Peace Prize?

- Muhammad Yunus, along with Grameen Bank, was awarded the Nobel Peace Prize in 2006. The Nobel Committee recognized their efforts in creating economic and social development from below by empowering the poor through microcredit. This work has helped to reduce poverty and promote peace and stability in many communities around the world.

6. How does Grameen Bank help women?

- Grameen Bank primarily lends to women, who are often the most marginalized in society. By giving women access to credit, the bank helps them start or grow businesses, earn income, and improve the well-being of their families. Empowering women through microfinance has been shown to have positive effects on entire communities, including better health, education, and economic outcomes.

7. What is social business?

- Social business is a concept introduced by Muhammad Yunus. It refers to a type of business that is created to solve social problems, such as poverty or lack of education, rather than to make a profit. Any profits generated by a social business are reinvested in the business to further its social mission, rather than being distributed to shareholders.

8. What are some examples of social businesses created by Muhammad Yunus?

- Some examples of social businesses that Muhammad Yunus has helped create include Grameen Danone, which produces affordable, nutritious yogurt to combat malnutrition in Bangladesh, and Grameen Shakti, which provides renewable energy solutions, such as solar power, to rural communities in Bangladesh.

9. What challenges has Muhammad Yunus faced?

- Muhammad Yunus has faced several challenges throughout his career, including criticism of the microfinance model, which some argue can lead to over-indebtedness. He also faced a dispute with the Bangladeshi government in 2011, which led to his removal from the position of managing director of Grameen Bank. Despite these challenges, Yunus continues to advocate for social business and poverty alleviation.

10. What is the Yunus Centre?

- The Yunus Centre is a global hub for social business and microfinance, founded by Muhammad Yunus in 2012 in Dhaka, Bangladesh. The center focuses on promoting the principles of social business, supporting the growth of social enterprises, and advocating for sustainable development solutions. It also organizes events like Social Business Day to bring together social entrepreneurs and thought leaders from around the world.

11. How has Muhammad Yunus influenced the world?

- Muhammad Yunus has influenced the world by demonstrating that even small amounts of financial help can empower the poor to improve their lives. His work with Grameen Bank has inspired the creation of microfinance institutions in over 100 countries, and his concept of social business has opened new possibilities for solving social problems in a sustainable way. His ideas continue to inspire social entrepreneurs and policymakers around the globe.

12. Where can I learn more about Muhammad Yunus and his work?

- You can learn more about Muhammad Yunus by reading his books, such as “Banker to the Poor” and “Creating a World Without Poverty.” The Yunus Centre’s website also provides information about his ongoing projects and initiatives. Additionally, numerous documentaries, interviews, and articles are available online that detail his life and achievements.